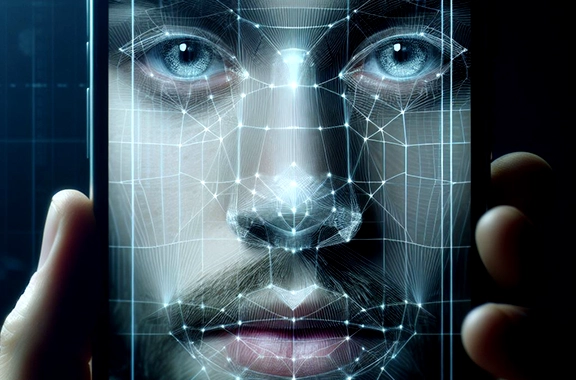

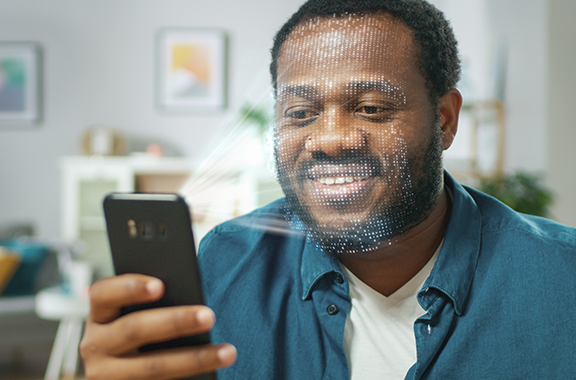

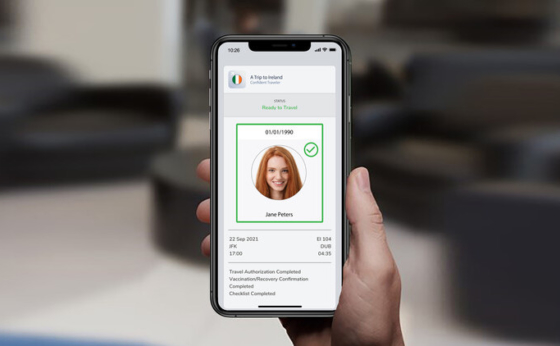

Beyond NFC: Mobile Driver’s Licenses are Revolutionizing Digital Identity Verification

From increased security to enhanced privacy, mDLs are poised to create a seismic shift in how we manage and share identity information, and digital identity verification...

Fall 2021">

Fall 2021">

You Verify">

You Verify">