eKYC 101

Everything you need to know about electronic Know Your Customer and how it can secure and streamline your onboarding process.

The world has changed dramatically since the first Know Your Customer (KYC) guidelines were introduced to combat financial crime through the U.S. Bank Secrecy Act of 1970. As technology, crime, and customer expectations have evolved, this procedure for verifying the identity of new clients has been revised numerous times.

Electronic Know Your Customer (eKYC) brings what has long been a face-to-face identity verification process into the digital age, meeting the needs of customers who want to create and access accounts online and organizations that need to weed out fraudsters.

While some industries like banking and insurance are mandated to implement KYC and eKYC technologies by regulation, other businesses can equally benefit from eKYC’s ability to protect companies, data, and customers.

How Does eKYC Work?

To ensure a customer is who they claim to be when they open an account in the physical world, an organization would traditionally have required the customer to present a government-issued ID and other documents.

eKYC, however, combines the security and convenience of document verification and biometrics to digitally verify customer identities.

Government-Issued ID

Even in the digital world, government-issued IDs play a key role. Since most ID documents, such as driver’s licenses, identity cards, and passports, are still physical, they must be photographed or scanned for use in eKYC.

In the future (and in increasing use cases right now), many IDs will turn digital. Juniper Research estimates that by 2024, five billion people will have electronic government-issued digital identity credentials.

According to FedTech Magazine, the three U.S. states that currently offer digital driver’s licenses (Arizona, Colorado, and Maryland) will soon be joined by 10 more.

The EU is also developing European Digital Identity, a digital wallet that can be accessed via phone or other mobile device and which will provide proof of identity in physical and online environments. The Geneva Internet Platform’s DigWatch adds, “A majority of governments that have issued digital IDs are LMICs [low- or middle-income countries] in Africa and Asia.”

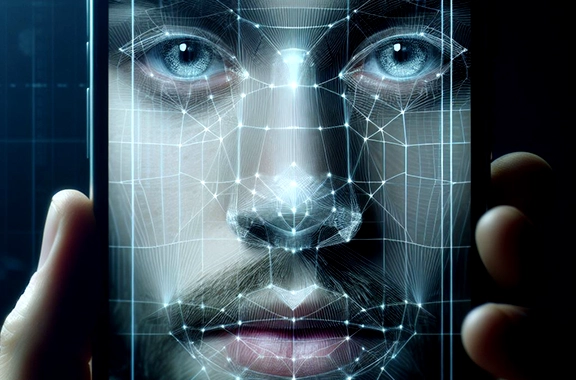

Biometric Identity Verification Technology

Biometrics refers to technology that uses the unique physical characteristics of a person, like their fingerprint, face, or voice, to identify that person. eKYC uses biometrics (most commonly a fingerprint or facial scan) in conjunction with an ID document to confirm a customer’s identity.

A typical eKYC process that incorporates biometrics will involve a customer being prompted to take a photo of their ID document and to snap a selfie, which is then compared against the face image on their ID and checked for liveness to avoid spoofing like deepfakes or still photos. Often, other data the customer enters during the onboarding process is cross-checked against the PII data extracted from the ID. During eKYC, the organization can even check the captured image and data against a fraud watchlist, preventing known bad actors from completing the onboarding process.

Why Does eKYC Matter?

Fraud is on the rise as criminals and the technology they use grow ever more sophisticated. In its 2022 Identity Theft Report, Javelin Research & Strategy noted that identity fraud amounted to $52 billion and affected 42 billion consumers. In its “State of Fraud 2023” report, Signifyd found that the total cost of e-commerce fraud will reach $206.8 billion during 2023. The LexisNexis Risk Solutions 2022 True Cost of Fraud Study reported that the cost of fraud for U.S. and Canadian financial services firms had risen 22.4% since early 2020 and that the cost of fraud is highest for U.S. banks, where every $1 of loss actually costs $4.36.

eKYC decreases the likelihood of organizations falling victim to both identity and other types of fraud losses. Through secure, convenient identity verification, eKYC gives businesses the confidence that they’re only onboarding and granting account access to true customers – not fraudsters.

How to Set Up eKYC

The eKYC process starts when a customer opens an online account. As part of the larger digital onboarding process, a business determines what happens before the customer is asked to verify their identity, whether that’s simply creating a username and password or filling out a short online form.

Next, a customer will have to provide proof of their identity. This typically entails capturing an image of their driver’s license or passport and uploading the captured identity document. Then, the customer needs to provide proof that they are truly the person identified in the document. This can be accomplished by taking a short live video of themselves, taking a selfie that can be compared against the photo on their ID, or, for documents that also include a fingerprint, placing their finger on the fingerprint reader of their laptop or mobile device.

In the background, the person’s identity is checked against third-party databases, which can range from simple address verification to fraud and terrorist watch lists, depending on the business and regulatory needs.

Before determining what factors a customer will have to provide and which background databases should be checked, it’s important for organizations to consider the regulatory environment for the industry they operate in as well as the region in which they operate. For financial institutions and other firms required to do due diligence, eKYC helps businesses meet anti-money laundering (AML) regulations by verifying customer identity and assessing that customer’s risk level. Depending on where a business is located and what industry it’s in, the eKYC process may also need to comply with other regulations, like terrorist financial rules, or even need to integrate the EU’s electronic identification standards and trust services (eIDAS) or the Unique Identification Authority of India’s AADHAR biometric identity standard.

While any business needs to understand its industry and customers before setting up eKYC, no business has to go it alone: there is a wide variety of identity verification solutions and vendor expertise available in the digital identity market.

Benefits of eKYC Technologies

eKYC both streamlines the process of verifying the identity of new customers and increases data security. It does this in part by automating what traditionally has been a manual process that required time and (often erroneous) human intervention. Today’s leading eKYC processes rely on AI-powered biometric algorithms and technology that can operate at an error level that is slim to none, meaning fraudsters are kept out and true customers are conveniently allowed to open accounts or onboard. The decision-making behind the identity security technology used for eKYC, like document verification, watchlist support, and liveness detection, all happens behind the scenes, offering no interruption to user experience or friction-filled steps. Market-leading eKYC processes take about 1 minute or less for customers to complete. The use of biometrics in eKYC also offers accessibility and financial inclusion for a wider group of customers, as the in-person barrier of traditional KYC processes is eliminated.

eKYC vs. KYC

eKYC offers several benefits over traditional KYC, including better customer experience, improved conversion rates, and scalability.

Traditional KYC is time-consuming and can be frustrating for customers, requiring them to take their identity documents to a physical location, complete paperwork to open an account, and wait for someone to go through the process of verifying their identity. In contrast, opening an account and verifying identity through eKYC takes just minutes and customers never have to travel anywhere – a burden which affects some customers more than others and which creates an unfair barrier to accessibility.

By streamlining the identity process online, eKYC services also ensure potential customers successfully open accounts. Each step in traditional KYC is an opportunity for customers to become frustrated and leave without completing the process. Clearly, one benefit to KYC is getting your customer relationships off to a better start from the very beginning.

Reap the Benefits of Automation

By automating the identity verification and verification process and enabling it to be completed online or through apps, eKYC makes the verification process infinitely more scalable, as there’s no need to hire additional human resources. eKYC checks the authenticity of documents against known demographic information, government watchlists, and other third-party databases. It also can confirm that the device being used to onboard is in the same location as the person claiming to own that device and identity. Automation enables eKYC to approve or deny the customer at a speed no person can match and to scale up quickly when needed.

Minimize Risk and Fraud

eKYC offers more security against fraud than traditional identity verification. With its ability to:

- automate deeper background checks,

- integrate government-issued IDs, whether they are physical or electronic,

- layer and analyze multiple identity factors, such as a driver’s license, a selfie, and a biometric facial scan,

- and assess risk,

eKYC provides better assurance that a new customer is authentic and not a bad actor.

Get Support for Industry-Specific Use Cases

Banks and financial institutions are the primary targets of cybercriminals, who are constantly developing new scams for committing money laundering, identity fraud, and other financial crimes through online and mobile accounts. With its ability to rapidly perform deep background checks and assess risk, incorporate the use of biometrics and liveness checks to thwart the use of video and still images, and to eliminate human error, eKYC provides the highest level of assurance that the customer opening an account is the person they claim to be. In the heavily regulated financial services industry, eKYC can also improve compliance with KYC and anti-money laundering (AML) rules, violations of which cost financial firms $5 billion in fines in 2022.

The insurance industry has rapidly transformed from one where policies have been sold face-to-face to one where customers can easily self-serve their insurance needs online. This has opened the door to fraudsters who seek to capture the large amounts of money and PII (personally identifiable information) available in the industry. Like banking, insurance is heavily regulated. eKYC can help ensure a customer is who they claim to be and improve an insurer’s adherence to compliance. Another benefit it offers to insurance organizations is the ability to quickly assess the risk of a customer by providing insight into any suspicious claims in their past, for example, which is hard for an insurance agent to do thoroughly during a physical interaction.

Gaming and betting firms need a quick way to verify new customers’ ages and identities. These businesses and industries at large are common targets for fraud, including money laundering, and must especially guard against underage gambling and gaming. eKYC can quickly, securely, and easily verify identity and age, helping to keep gaming and betting companies in compliance with government regulations.

In real estate, as the number of homes bought and sold online has risen, so has the opportunity to commit crime against mortgage origination, mortgage servicing, and title/settlement firms. Real estate companies have been trying to balance the need for secure identity verification with the friction it can cause – if relying on traditional methods – in customer processing for quite some time. eKYC can bridge these concerns with highly secure identity verification that can be completed quickly and transparently for all parties.

Why Your Company Needs eKYC

Cybersecurity Ventures expects global cybercrime to reach $10.5 trillion annually by 2025, noting, “This represents the greatest transfer of economic wealth in history.”

Implementing eKYC identity verification as part of the customer enrollment process is an important way to help protect businesses and customers from becoming another fraud statistic. Falling victim to identity-based fraud can negatively impact a business’s reputation, causing current customers to leave and potential customers to choose competitors instead.

The initial financial cost of identity fraud is only the beginning of the total loss. For organizations in industries where eKYC is part of regulated due diligence, properly implementing it can help avoid additional regulatory fines. eKYC can also strengthen customer relationships by showing the public that a business is truly committed to protecting its customers, accounts, and data, all while simplifying the often friction-filled process of verifying customer identity by using biometrics.

See how Daon can help you implement the right eKYC strategy for your business. Contact us today for more information.