The Power of CIAM

Customer personalization possibilities for businesses are endless with CIAM

by Ralph Rodriguez, CPO

January 24, 2023

In today’s business environment, customer personalization and trust go hand in hand. Unlike security, which only appears when something goes wrong, consumers judge every interaction to reinforce or erode their trust and brand loyalty.

However, with personal data under attack on all sides from enumerable, faceless cybersecurity threats, organizations face the brunt of the work when it comes to appeasing customers while maintaining the highest possible level of security.

As customer personalization crystallizes as both a responsibility and an opportunity, financial organizations should step back and appreciate that retrofitted IAM systems aren’t working. These platforms were designed for static employee identity and access management, along with other make-shift fixes. Delivering convenience and customer personalization with security requires using a specially tailored ecosystem of integrated solutions and capabilities.

Customer identity and access management (CIAM) systems have value through the lens of customer personalization (as well as privacy).

Only with these modern CIAM products and their capabilities will organizations find themselves competitively positioned now and into the future.

Evolving Understandings of Customer Personalization in a Digital Age

There are a few reasons why many organizations face an endless series of industry pressures. Rising customer expectations are front and center. Recent history demonstrates just how quickly we grow accustomed to new technological capabilities. For example, access to the internet began as a government project in the 1980s, and now, it’s labeled a “basic human right,” with the United Nations calling for universal internet access by 2030.

In the same vein, consumers have grown accustomed to highly personalized marketing strategies, particularly as they involve product recommendations. These capabilities didn’t exist at the turn of the century and are the product of highly sophisticated algorithms. But major brands, like Amazon and Netflix, make it look easy. As a result, customers have a taste for what’s possible, and receiving anything less is perceived as a lack of effort.

Post-pandemic data show us that customer service sits at the heart of brand loyalty, with roughly 80% of consumers expressing that the customer service they receive from brands is just as important as the products and services they purchase. In a fast-paced society, only two things are guaranteed: online commerce sophistication will only increase, and customer expectations will rise commensurately.

Since the regulatory environment for banking tends to favor consumers, many financial organizations face the brunt of maintaining regulatory complaints, remaining vigilant for suspicious activity, and providing seamless customer experiences to individuals with an attention span measuring in at 8 seconds. As a result, these organizations are on the defense, devoting a tremendous amount of time and energy to keep systems from collapsing.

This doesn’t bode well for companies still relying on horrifying, Frankenstein-esque systems built from retrofitted IAM technology and random, added bits of code. These systems simply haven’t done the trick, and they’ve been poor substitutes for the holistic identity and access management systems needed to keep customers engaged and operations secure. Companies can no longer drag their feet with today’s array of security threats.

From Lions, Tigers, and Bears to the Scourge of Cybercrime

Organizations know that their customers expect highly personalized experiences. So, why do less than 20% of consumers report customer service experiences that exceed their expectations?

Today’s most pressing threats look different than they did hundreds of years ago when every day spent not running from a lion was considered a good day. One of the biggest concerns is identity fraud, which poses an insidious threat to financial organizations. The arrival of the digital age has put quite a bit of pressure on the banking system now that cybercriminals and thieves can run illicit operations at scale.

But that’s not all. Financial organizations face three primary pressures from their business environment, which come in the form of:

- Expectations for Convenience. The need to personalize and streamline user experiences had been situated directly at odds with financial organizations seeking the highest standards of confidence in authenticating users. Without convenient access, customers will quickly turn to a competitor.

- Government Regulations. Maintaining compliance with the growing regulatory environment against cybercrime requires increasing investments into IT systems and refined processes to avoid high fines for failing to abide by restrictions.

- Evolving Security Challenges. While synthetic fraud and identity theft have relied on passwords for some time, cybercriminals are also growing more and more capable of utilizing identity “spoofing” tactics. Cybercriminals will continue to refine and sophisticate their methods without end.

Poorly-suited identity and access management tools simply aren’t going to get the job done in terms of security. And the possibility that retrofitted, bulky IAM systems and piecemeal approaches will deliver the kind of interactions your customers expect is a far-gone fantasy.

CIAM for Security, Trust, and Customer Personalization

Decades ago, financial organizations protected themselves with systems built around passwords and unique strings of numbers for identity verification. Those systems are now easy prey in a digital age, as even biometrics can be spoofed. The only path forward is to think long-term.

The identity security crisis facing businesses and organizations is existential in nature because goals to build customer loyalty, trust, and security are often at odds with one another. This is most often the case for organizations that haven’t yet adopted CIAM systems.

It’s important to note that CIAM does not refer to a specific solution or strategy. Instead, it represents a paradigm shift in how businesses manage relationships with their customers.

Historically, technology has offered few opportunities to deliver personalized marketing and customer service experiences. That’s changed drastically today, though, as insights can be gleaned from the simplest data points and customer interaction. This change is only possible when several elements are brought together: real-world and digital identities, big data analysis, customer service personnel, and creative leadership.

The CIAM shift stresses adaptability, flexibility, and scalability when delivering more personalized identity and access capabilities to organizations. Essentially, these systems integrate various siloed elements of your business to achieve more dynamic omnichannel personalization for consumers while maintaining high levels of security and vigilance to protect all parts of the system.

Six Distinguishers of CIAM

Six powerful characteristics and features differentiate CIAM systems:

- Top-tier authentication systems. At the core of CIAM systems is their ability to enable industry-leading security and authentication measures. These authentication systems are equipped with cutting-edge protocols that are constantly updated to provide the most protection possible. By insulating organizations and their customers from the threat faced by counterparts without CIAM systems, business leaders can spend less time worrying about how to tiptoe across the security-customer experience tightrope and focus on boosting the quality and delivery of their solutions offerings.

- Cloud-based operations. With a higher degree of security through rapid patching and updating, businesses can more confidently offer cloud-based operations, which enhance customer convenience by making solutions more accessible, regardless of geographic location, device, and other factors.

- Scalable integrations. Your customers aren’t the only ones who benefit from convenience and versatility. CIAM systems are designed for integration and scalability once put to work for your organization. This doesn’t come from their cloud-based nature alone. It also stems from customer-facing integrations, allowing for a selection of personalized customer options that advance as your company evolves, helping you keep up with the rapid pace of today’s business environment.

- Enhanced platform functionality. By centralizing features and tools under a single platform with optimized UX, users without advanced programming knowledge can still feel in control of their CIAM systems. Financial organizations can more easily adapt and refine their utilization of CIAM functionality when they offer the types of systems that allow key business leaders to quickly adapt to the system’s environment.

- User support. Even with a platform optimized for seamless and intuitive user experiences, the degree of sophistication and complexity inherent in modern CIAM technologies requires expert support to make sure users are utilizing platforms to their utmost potential.

- Interface customization. CIAM systems are designed to control how and to what degree you personalize your customer-facing login interface. This can help you deliver the degree of consistency and user satisfaction capabilities that bring your security aims in line with your personalization and trust-building goals.

Competitive Advantages of CIAM-Enhanced Customer Personalization

Personalization is at the root of security, trust, better marketing, and seamless customer service. The root of personalization is knowledge of and familiarity with an individual. In nature, human interactions are personalized thanks to the unique bank of collected memories and thoughts associated with a person over time. However, businesses can’t count on those individual memory banks as much once they reach a certain size.

Business functions tend to be siloed, and personalization trends are largely a product of how specialized and sophisticated those functions and responsibilities have become. While separate processes allow a business to function efficiently, the sum of these procedures takes a major toll on customer service interactions. The solution some businesses have developed is multiple customer service lines, which cut across the organization and focus on meeting customer needs.

Yet, that still isn’t enough to deliver personalization. To accomplish that at scale requires technologies capable of thinking like humans and bringing all relevant elements of the business and the customer into one place. By uniting the power of data, technology, personnel, and organizational governance, CIAM brings their combined potential under your control, allowing for more data-driven decision-making. The resulting competitive advantage derived from customer personalization capabilities manifests in many ways, from marketing, to security, to strategic planning.

Integration of Consumer-Facing Data and Technologies

CIAM systems offer more dynamic and customizable user authentication functions, delivering peace of mind while keeping customers engaged. To reduce the number of abandoned customer registrations and shopping carts, for example, your platform can use MFA (multi-factor authentication) methods that allow a user to login via their social media account credentials, for example, accessing a certain degree of use before eventually being prompted to create a solution-specific account.

Without CIAM systems, user information tends to be decentralized. This becomes especially challenging for customer service representatives as they attempt to provide seamless assistance while still being forced to ask fundamental questions about customer identity and order history.

Larger data and AI capabilities give rise to dramatically increased functionality in terms of metadata insights from a comprehensive analysis of customer behavior and interactions. The result is multiple benefits, from precisely timed content and product suggestions to more targeted marketing campaigns. These capabilities also help financial organizations find and target fraudulent activity.

For example, while synthetic fraud is difficult to detect – and can cost institutions an estimated $20 billion per year – using CIAM systems for biometric identity verification removes the burden from these organizations. The verification is instead handled entirely by CIAM system protocols that keep fraudsters at bay.

With more integrated omnichannel personalization capabilities, users will be more likely to link their social media accounts and other digital and in-person channels, allowing more suspicious, static, and unidimensional users to stand out, resulting in earlier flagging. Integrating various digital and in-person identities makes the possibilities of personalization endless.

Powerful Customer-Side Analytical Insights

The data reporting from client-side analytics can be skewed by user-side elements, like ad blockers, making that data less accurate and less meaningful. But by using CIAM, financial organizations gain insights from uniform and comprehensive data reporting, such as records of each authenticated user login.

This allows you to more accurately keep tabs on data points, such as customers’ familiarity with your product, which is just one way to develop more targeted marketing strategies. CIAM systems deliver a powerful, competitive advantage by establishing holistic customer identities across channels while ensuring the highest data protection and security standards.

Enhanced Trust and Reputation Protection

Added personalization does not come at a cost to your security measures. The enhanced security mechanisms of a CIAM system help to minimize the possibility of stressful and reputation-tarnishing breaches. This is particularly important for financial organizations. Remember that the existential crisis for most businesses and organizations is maintaining the delicate and challenging balance between customer identity management, security, and trust. The best solution is one that boosts all three elements, where no single element comes at the cost of another.

When customers lose access to their financial products, they may receive more protection and therefore be less likely to face a loss. Still, they must go through the trouble of sorting out the mess, proving their identity, and then regaining access to their lost products or income. This can mean weeks of hassle before regaining a sense of normalcy. The issue here involves trust, not only convenience, and it can’t be easily undone once there’s an incident.

Customer Personalization in an Ecosystem of CIAM Solutions

Technology advances quickly, with software adoption becoming more of a competitive differentiator by the day. Outsourcing CIAM support leaves your organization vulnerable to the consequences of inattentive or under-resourced partners. This matters because the CIAM technologies themselves won’t be enough unless they can be leveraged to their full potential and monitored by highly-capable experts.

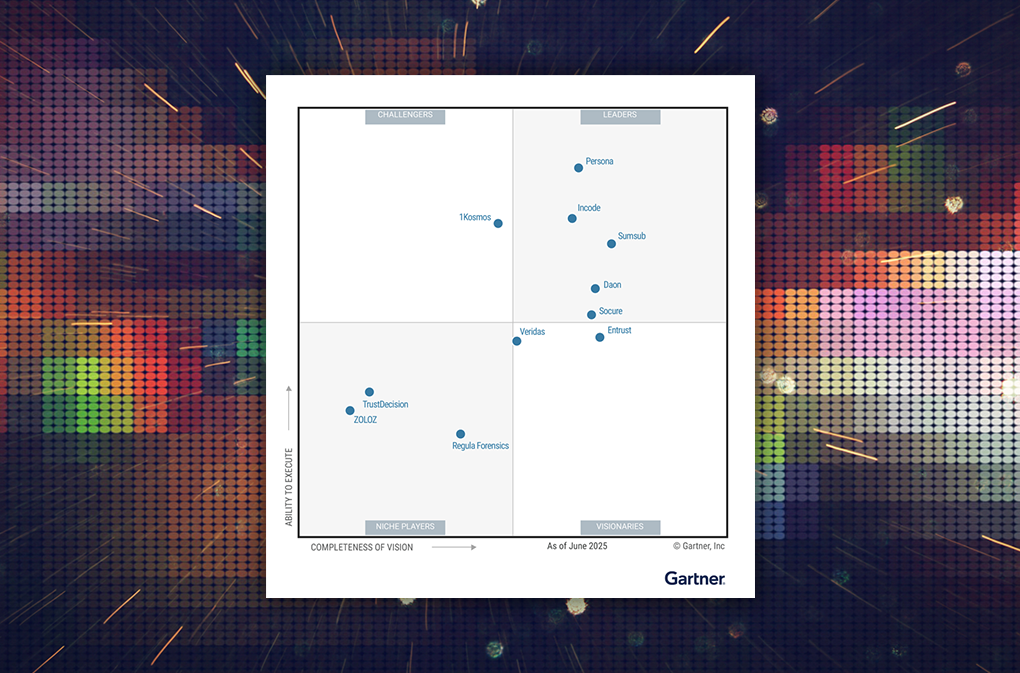

That’s why organizations trust IdentityX®. IdentityX is backed by Daon’s experienced, global team of customer service representatives and over 20 years of industry innovation.

To learn more about how your organization can benefit from IdentityX, visit our Solutions page.