The Role of AI in Digital Identity Verification

AI can transform the security of your CIAM/IAM, protecting customers, data, employees, and brand reputation with advanced biometric identity verification.

Identity fraud is on the rise. The National Council on Identity Theft reported that total fraud and identity theft cases have nearly tripled over the last decade, noting, “Identity theft scenarios are increasing drastically in 2023.” Jupiter Research has estimated that global merchant losses to online payment fraud, which includes the use of synthetic identities and account takeovers (ATO), will reach $206 billion by 2025.

This challenges businesses that enable digital account and payment access to find identity verification solutions that are accurate, secure, and convenient, all while deterring fraudsters without adding friction for legitimate customers.

A growing number of digital identity verification solutions rely on artificial intelligence (AI) to solve these problems.

What is AI?

According to McKinsey, at its most basic level, “AI is a machine’s ability to perform the cognitive functions we associate with human minds.” The Brookings Institution writes that artificial intelligence algorithms are designed to make decisions “using sensors, digital data, or remote inputs” and to “combine information from a variety of different sources, analyze the material instantly, and act on the insights derived from those data.”

A key characteristic of AI is machine learning (ML), which enables AI to improve as its experience handling a task, such as identity verification, grows. According to MIT Sloan School of Management, “Machine learning is a subfield of artificial intelligence that gives computers the ability to learn without being explicitly programmed.” This means that if AI ever makes a mistake, it will only make it once. AI is continually learning, and its knowledge grows with each interaction. Tech Target found that ML “allows software applications to become more accurate at predicting outcomes.”

With AI, digital identity verification is faster, more accurate, and more efficient than when it’s performed by humans. This is particularly true for the many forms of biometric identity authentication. Unlike knowledge-based authentication (KBA) that relies on things users know, such as their mother’s maiden name, third-grade teacher, or high-school mascot, biometric authentication relies on physical characteristics to verify identity. AI’s ability to analyze data, extract key features and characteristics, and recognize the patterns in them makes it an ideal technology for use in biometric identity solutions.

Four benefits of AI for biometric authentication

AI significantly outperforms humans at comparing the characteristics of a biometric factor, like a voiceprint or facial scan, against the speech or selfie being provided by a user for account access during onboarding. This difference in speed between AI and humans was illustrated by Simplilearn: “In the instance that the human mind can answer a mathematical problem in five minutes, artificial intelligence is capable of solving ten problems in one minute.”

Another benefit of AI is that it’s capable of analyzing amounts of data that would overwhelm any person and find trends and patterns a person would never see, making AI more accurate than humans at identity verification and authentication. It doesn’t get tired, have a bad day, or fall victim to human error. In its article “AI and biometrics key to building trust in a digital world,” Cyber Magazine reported that researchers from Tessian and Stanford reported that approximately 88% of data breaches are caused by human error. In contrast, AI is always on guard, looking for patterns or anomalies, and accurately interpreting from them whether account or data access should be granted or denied.

Artificial intelligence efficiently and consistently handles volumes of identity verification attempts. Whether it’s a low traffic day, a busy payday, or Black Friday, AI handles all account access attempts with the same speed, process, and accuracy, avoiding queues that cause unhappy customers.

AI is also much better at defending against deepfakes, synthetic identity fraud, and other malignant AI-based technologies that are increasingly being used by fraudsters and can be difficult for humans to detect.

How AI works with biometric authentication factors

Let’s take a deeper look at how some commonly used biometric authentication factors benefit from the use of AI.

Behavioral biometrics

Behavioral biometrics verifies a user’s identity by analyzing the patterns in the way they perform activities. From swiping between screens on a tablet or mobile device, to keystroke patterns, to moving a mouse or shifting the cursor on a screen, every action performed by a user has characteristics that are quantifiable and can be used to confirm identity. AI makes behavioral biometrics practical to use for digital identity verification because it can analyze these patterns in real time and accept the user, unmask an imposter, or expose an automated bot quickly enough to avoid customer friction and any potential damage from an intruder.

Voice recognition

Voice authentication is another factor made useful by AI. Voice recognition identifies people as they speak, analyzing either a specified phrase (active voice authentication) or natural speech patterns (passive voice authentication) during normal conversation, like when a customer is explaining their issue to a contact center agent or asking a virtual assistant to turn on the lights. When a customer onboards, they provide a speech sample (either active or passive). AI identifies the characteristics of the voice from this sample, including speech patterns like tone, accent, and voice cues about gender and age, analyzing the data to create a voiceprint. When the user returns, AI compares their live speech against this voiceprint to confirm their identity.

Facial recognition

Facial authentication is one of the most frequently used factors for verifying identities, from unlocking a smartphone to accessing a bank account. When a customer activates the facial recognition feature on their device, a facial scan is captured. AI analyzes the scan and extracts the characteristic points, creating a biometric template that will be compared against the person’s live face scan the next time they return for access. When people open a bank account online, for example, they are typically asked to provide a government-issued photo ID and a selfie. AI will compare the ID photo and date with the selfie to ensure they represent the same, genuine person. Additionally, AI uses liveness detection to check the selfie for “liveness,” assuring it’s an image of a live, real human being and not a deepfake or presentation attack like a previously taken photo, screen shot, or still image from a video presented by a fraudster. If everything checks out, AI creates the faceprint and the customer will be able to access their account using facial recognition.

Continuous authentication

Continuous authentication uses AI to extend ongoing verification across a customer’s entire session instead of simply verifying identity at the beginning of their access. This helps to protect against the type of account takeover (ATO) attacks where fraudsters co-opt the session that has been initiated by the verified customer. By continuously monitoring and analyzing the customer’s behavior throughout the entire session, AI can confirm their identity. If it detects any change in the known behavior patterns, AI can flag these changes and prompt additional authentication steps, such as triggering a request for multi-factor authentication.

Anomaly detection

In anomaly detection, AI analyzes user behavior and identifies patterns that differ from a user’s typical or established actions, flagging transactions or activities that stand out so an organization’s CIAM/IAM can initiate security measures. A common example of this is when a customer logs in from a new device and is alerted that access is being attempted, prompting them to confirm that they are the person seeking access. AI can also request that the customer provide additional factors to verify their identity.

Fighting identity fraud with AI

The role of AI in identity verification will continue to increase as both the methods that criminals use for identity fraud and the biometric factors that combat them grow more sophisticated.

AI increases the security and effectiveness of biometric authentication solutions, helping businesses protect customer accounts and data and avoid losing money to cyberattacks and fraud. It works at a speed and scale that ensures customers can securely access their account without delay and provides accuracy that minimizes false rejection of legitimate users.

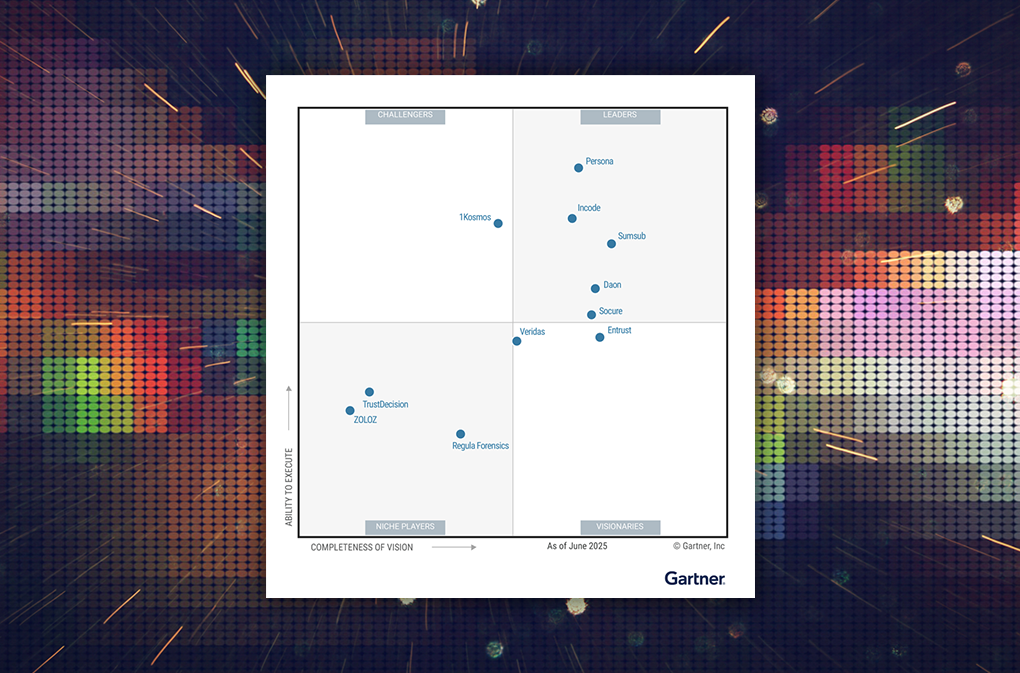

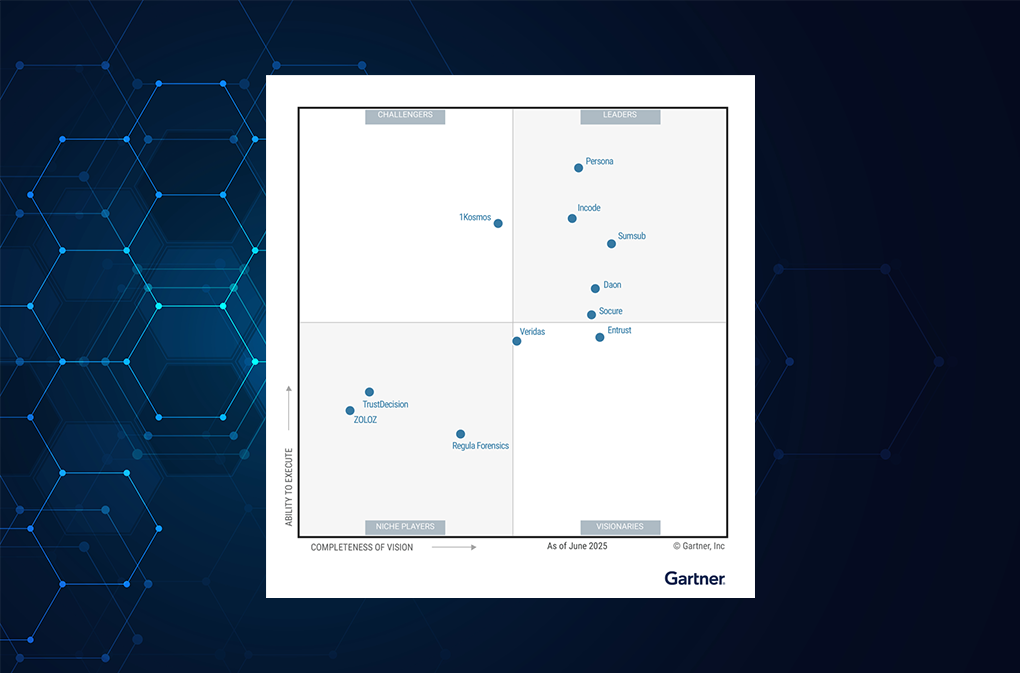

See how Daon’s AI-powered biometric solutions combine advanced security with convenience to create a single, seamless identity experience for your customers.